TMX POV - Bitcoin in a Familiar Package

We all can only imagine what it is like to be Stefan Thomas. It's gut wrenching to imagine what he is experiencing. So close but yet so far.

If you are not familiar with Stefan's situation, it's the kind of story that sounds more urban legend than true. Stefan is a San Francisco-based programmer that has only two of ten guesses left to unlock a digital wallet that holds as of January 27th, approximately $225 million USD in bitcoin.

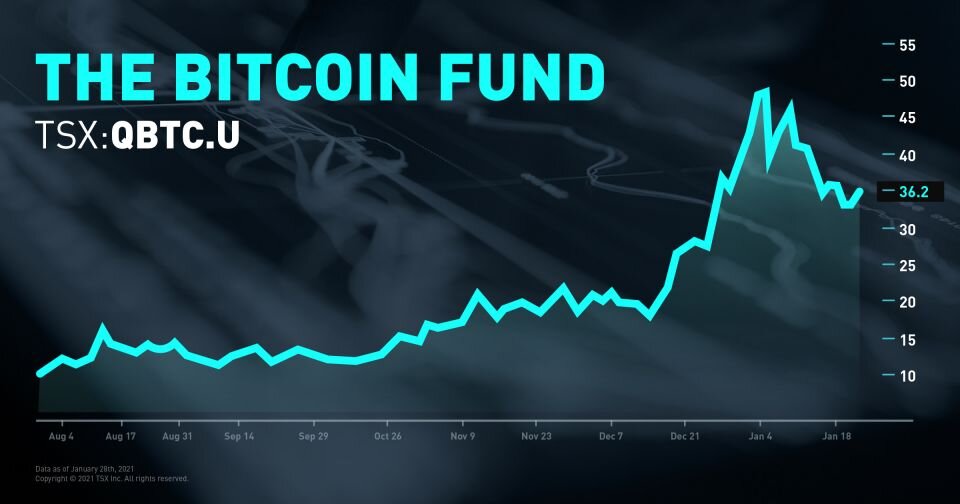

In 2020, Toronto Stock Exchange (TSX) was the first major North American exchange to list a bitcoin fund (The Bitcoin Fund, TSX: QBTC and QBTC.U) followed by being the first major exchange in the world to list another cryptocurrency ether (The Ether Fund, TSX: QETH.UN and TSX: QETH.U). Each of these closed-end funds were brought to market by Canadian alternative asset manager 3iQ Corp. Since then, Canada's largest exchange listed its third and forth crypto closed-ended funds (CI Global Asset Management's CI Galaxy Bitcoin Fund, TSX: BTCG.UN and BTCG.U - Ninepoint Partners' The Bitcoin Trust TSX: BITC.UN and BITC.U).

The need for investment alternatives

Bitcoin and other crypto currencies have risen sharply since the November 3rd US presidential election.The internet is littered with articles and stories of both Bitcoin's spectacular gains and the risks associated with crypto investing.

On January 11th, UK's investment watchdog the Financial Conduct Authority (FCA) went so far as to state, "If consumers invest in these types of product, they should be prepared to lose all their money." The regulator's warning to the public also implied that it's not just the investment in cryptocurrencies that investors should be wary of but also those selling them.

Even if an investor's risk appetite can handle the fluctuations of Bitcoin investing, their assets need to be stored safely. A Reuters article from November 2020, indicates that although crypto crime is slowing, it is still an issue with nearly $1.8 billion in "thefts, hacks and fraud" in the first 10 months of 2020. The article further states that the industry has implemented more and better procedures to protect funds.

Overcoming the regulatory hurdles

In its 2018 denial of nine ETF applications, the US Securities and Exchange Commision (SEC) stated its decision was not on the evaluation of whether bitcoin has "utility or value as an investment" but its concerns rested on investor protections from fraud and manipulative behaviours related to the trading of the underlying securities.

In Canada, the Ontario Securities Commission (OSC) noted in rulings related to 3iQ Corp.'s application for The Bitcoin Fund that its primary concerns were related to "bitcoin's liquidity and the integrity of the bitcoin markets" as well about the fund manager's "ability to value and safeguard its bitcoin and file audited financial statements." 3iQ supported its application for The Bitcoin Fund by proposing well regarded Raymond Chabot Grant Thornton as its auditors and New York based Gemini as its custodians. The OSC's reasons and decision dated October 29, 2019 stated 3iQ Corp. had taken "reasonable steps to mitigate the risks associated with the [The Bitcoin] Fund and the bitcoin markets through the structure of the [The Bitcoin] Fund and the use of professional and qualified third-party service providers".

Investments in crypto coins are held in digital wallets, there two basic types of storage wallets, those that are "cold" and those that are "hot". A "hot" wallet is connected to the internet while the "cold" is not. The coins for all four crypto funds on TSX are held by Gemini in a segregated "cold storage" system. This type of warehousing is more secure as it's not connected to the internet where external hackers may lie.

How have exchange listed closed-end funds helped close that gap?

In the same decision where the SEC rejected nine ETF applications, the US regulator stated, "... that, compared to trading in unregulated bitcoin spot markets, trading a bitcoin-based ETP (exchange trade product) on a national securities exchange may provide some additional protection to investors."

Prior to the listing of 3iQ Corp.'s, CI Global Asset Management's and Ninepoint Partners' funds on TSX, investors were limited to opening trading accounts away from their traditional investments. It frequently meant dealing with new emerging counterparties and exchanges they don't know. The advent of TSX listed crypto funds now allows sophisticated investors to access digital currencies in the same way that they manage the rest of their investments. For the individual investor, they can even be put in a RRSP portfolio.

Cryptocurrency and blockchain is an emerging industry in Canada and around the world. TSX and TSX Venture Exchange (TSXV) are home to many companies that provide services to the industry, bitcoin miners, and payment processors. There are numerous TSX and TSXV listed companies that service the industry as well as ETFs that track the industry.

How is investing in a closed-end cryptocurrency fund different from owning the coins outright?

Closed end funds listed on TSX provide access to digital assets while avoiding the pitfalls and security concerns that are sometimes tied to the over-the-counter and unregulated crypto markets.

It is nice to know that while Stefan tosses and turns trying to remember that lost password, investors can look at TSX and TSXV-listed funds and companies as a way to access this new asset class.

Originally published at tmx.com on January 28, 2021.

Copyright © 2021 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this article without TSX Inc.'s prior written consent. This article is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided in this article is not an invitation to purchase securities listed on Toronto Stock Exchange (TSX) and/or TSX Venture Exchange (TSXV). TMX Group and its affiliated companies do not endorse or recommend any securities or funds referenced in this article. TMX, the TMX design, The Future is Yours to See., Toronto Stock Exchange, TSX, TSXV and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc.